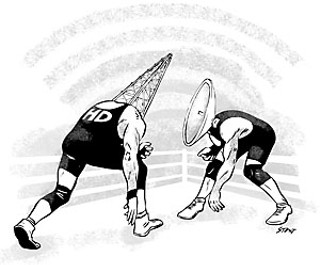

Worldwide Radio Wrestling!

HD format hopes to body-slam satellite radio to an industry draw

By Kevin Brass, Fri., Dec. 22, 2006

Like the heavy metal fanfare for a wrestler approaching the ring, the drumbeat has begun for HD Radio, the long-awaited entrance of traditional radio into the digital arena. Radio companies are using $200 million in advertising time to tout HD as the Great Tech Hope, the chance for old, fuddy-duddy "terrestrial" radio to show it has the stuff to compete with satellite services and the Internet. With the bombast of a World Wrestling Federation ring announcer, the industry proclaims HD "the biggest trend in consumer entertainment since the advent of FM radio!"

But ask your friends and neighbors about HD Radio, and they'll likely respond with a blank stare and "huh?" Go to a store, and try to buy a receiver, and chances are the polo-shirt-clad zombie will send you to the DVD department. And if you do buy a receiver, you'll find only a smattering of channels available, ranging from smooth jazz to a "rockin'" country channel.

Nevertheless, in an industry desperately in need of some good news, HD – the industry's not-quite-acronymic designation for digital radio – is seen as a potential savior, a chance to compete in the modern age. "It's something we have to do, or the business will pass us by," says John Hiatt, Austin market manager for the four stations recently purchased from CBS by Entercom.

But as HD takes its baby steps into the market, serious questions linger. Is it too late? Can the radio industry – the world of perky morning shows and "adult contemporary" formats – pull it off? And, perhaps, the most nagging, crucial question of all: Can HD make commercial radio cool again?

Rollout Alliance

In many ways, HD – a term borrowed from "high definition," although it has nothing to do with HD television – represents a giant leap forward for radio. Reception in many areas will be crystal clear, static-free, much like the jump from analog to digital phones. And, like satellite services, receivers will display information about the songs as they play. Best of all, HD allows broadcasters to offer more than one channel over a radio frequency, a technique known as "multicasting." For example, if you have an HD radio, you'll be able to listen to KVET-FM on 98.1, but you'll also be able to switch to KVET's HD-only channel on the same frequency, KVET-2 (and, eventually, KVET-3 and maybe even a KVET-4).

As a result, Austin radio stations will be able to offer a dozen new channels, no longer constrained by their designated frequencies. For KUT-FM, Austin's National Public Radio affiliate, that translates as an opportunity to broadcast national programs such as the BBC World News and The Tavis Smiley Show, that it can't fit on its main channel, on an HD channel. "It creates a new program stream for our local audience," said Rich Dean, director of channels for KUT.

To the commercial stations, it's a chance to roll out the type of diverse and niche-oriented formats that have all but disappeared from the radio dial. Formats like reggae, jazz, Tejano, oldies, and classical will find a new home on HD – and they will be offered for free to anyone with an HD receiver, a bitch slap to the pay-for-play satellite services. "A lot of people are excited about the chance to do these things," said Scott Gillmore, Austin market manager for Emmis Communications. "We can take a chance on this and look for things that create passion and listenership."

To launch HD, the largest radio companies, led by industry giant Clear Channel, joined together to form the HD Digital Radio Alliance. In an unprecedented display of cooperation, the members set ground rules for the rollout. In addition to agreeing to devote airtime for commercials promoting HD, stations randomly drew lots for different formats to avoid direct competition. For example, in Austin, Emmis' hip-hop station, KDHT (Hot 93.3), chose an "Old Skool" hip-hop format, and Entercom rival the Beat (104.3) picked up an "urban adult contemporary" format. Alliance members also agreed not to run ads on the channels for a year to help establish the format (although, after that, all bets are off).

Despite the cooperation and anticipation, HD's emergence into the market has been a sputtering, jerky affair. Receivers actually have been available for more than two years. But companies were slow to spend the $150,000 to $200,000 per station for broadcast equipment and the HD technology, which is controlled by a company called iBiquity. Stations that made the leap experienced a long series of technical problems, forcing further delays in the launch. KUT's HD channel was initially operational in January, but a long series of problems getting the hardware and software to work properly prevented the station from going live until September. Although the NPR affiliate's pioneering foray into the format was largely subsidized by grants, it ultimately dug into station funds to get all the equipment operational.

As far back as July, MediaWeek columnist Rich Russo suggested HD stood for "huge debacle." The HD Digital Radio Alliance says the problems have been solved and trumpets that there are now more than 1,000 stations around the country offering HD programming. But even now, as the local commercial stations air ad after ad promoting HD, many of the Austin stations don't expect to have their HD offerings on the air until next year.

Low Expectations

Multicasting – the ability to transmit more than one signal on the same frequency – is considered the "killer app" by many HD pioneers. But, so far, the multicasting programming offered by the commercial stations seems unlikely to send consumers into an HD-buying frenzy. Emmis' first HD channel, which hit the air the first week in November, is a smooth-jazz channel offered as a companion to KBPA-FM (the channel known as Bob). Most of the HD channels are extensions or variations of existing stations. Easy-listening Majic, for example, will offer an oldies HD channel. KLBJ-FM, the classic rock station, will offer a blues channel. At this point, all the channels are generic and automated, with no live voices.

While the new formats will undoubtedly add a level of diversity to the radio dial, most are readily available in many forms these days, including on satellite and a wide variety of Web services. It's also the reality of the modern media world that any hardcore blues enthusiast eager for a commercial-free blues extravaganza can simply dial up his favorite iPod playlist.

Equally uninspiring is the level of support for the format at the store level, a key ingredient for the rollout of any consumer electronics product. The HD Digital Alliance's big preholiday retail announcement was that Circuit City would carry receivers in 10 markets and online, the only big-box chain offering HD. Post-Thanksgiving, a North Austin Circuit City displayed one Boston Acoustics HD receiver on a corner shelf, behind several kiosks promoting satellite. The model was priced at $234 (after rebate), but it couldn't pick up any HD channels. "You'll need an amplified antenna," the salesman said. "I think once I've been able to pick up one HD station with this," he said, flopping around the flimsy, thin wire antenna included with the receiver.

Outside of Circuit City and RadioShack, the big chains are largely ignoring HD, so far preferring to stock shelves with products they apparently deem more likely to sell. Radio ads for HD often point people interested in buying a receiver to Web sites. And the HD receivers available are still expensive, usually in the area of $200 or more, which dampens enthusiasm for anyone eager to make the plunge.

At the very least, it's fair to say HD is not generating any momentum – the Big Mo – which is considered essential for establishing a new consumer electronics product. Think of the enthusiasm and interest generated in the early days by the DVD format or the buzz created by iPods. In the midst of the holiday buying frenzy, there's almost no buzz over HD, despite the radio ads and general industry hype. "I think the industry has done a really poor job of educating people about what HD radio is," said Dean of KUT. "If you went out and asked 100 people about HD Radio, 99 would not have heard of it, and the other one probably works in radio."

Even within the industry, debate rages about the technical aspects of the format and the launch's inability to "wow" consumers. Widely read analyst Sean Ross of Edison Media Research recently wrote about his disappointment with the initial HD experience, including his difficulty finding a receiver, crummy reception, and a less-than-thrilling sound quality. "I was somehow expecting the head-rush of loudness of, say, the THX 'the audience is listening' movie trailer," he wrote. "What I heard sounded a lot less processed than even the average FM station – as if the primary goal was to demonstrate CD-style clarity."

Not all broadcasters have been eager to jump on the HD bandwagon. Border Media Partners, which controls seven frequencies in Austin, primarily broadcasting Spanish-language channels, has no immediate plans at this point to invest in the equipment. "We will wait until the market becomes better defined," said Bob Proud, BMP's vice president of operations. "The number of Spanish-language households in Austin [that] have bought an HD receiver has to be close to zero." (It's worth noting that Border Media Partners doesn't have Web sites for its stations, either, so maybe it's not the best gauge of cutting-edge technology. Spanish-language giant Univision is supporting the launch.)

In its infancy, the HD rollout is getting knocked around by market forces. The four Austin stations that Entercom just bought still don't have HD gear (although it's on order). Previous owner CBS was reluctant to spend the money on the gear while it pursued a sale, according to management. At this point, "We don't know when it will go up," said local Entercom programmer Dusty Hayes.

Meanwhile, no one is quite certain what the future holds for industry giant Clear Channel, one of the technology's biggest supporters. The company is going private and selling off dozens of stations. Many insiders believe the moves will help the industry and HD's rollout – bringing more players to the competition and less focus on the quarterly share prices – but it might also slow the investment in the HD rollout. (Austin-based Clear Channel officials didn't return phone calls.)

With so much uncertainty, Kagan Research expects only 200,000 to 300,000 HD receivers will be sold this year. That number should jump to more than 2.5 million in 2007, but sales won't really start to ramp up until 2008, when 8.5 million will be sold, according to Kagan's model. From there, sales are expected to almost double every year, to 16 million in 2009 and 27 million in 2010. But that will still represent a relatively small percentage of the 100 million radios sold every year.

That's not blockbuster news for the commercial radio companies, who have seen their values plummet amid widespread Wall Street skepticism about their future revenue. "I think it will be a lot like FM radio," Hayes said. "It took a while to get into homes and cars, and then it became second nature." The industry, Hayes said, is "committed to make it work."

Circular Economics

Few doubt that HD digital technology will eventually become the standard for radio, but there are no guarantees it will grasp the public's imagination. The tech landscape is littered with cool products that didn't catch on, from Beta videotape to AM stereo. Digital television was backed by an entire industry and federal legislation mandated conversions, yet the rollout of HD television – universally viewed as superior technology – is taking decades, not years, to worm its way into a significant number of homes.

At the same time, fundamental shifts are taking place in consumer habits. Internet radio, podcasts, and portable media are all in their infancy. Meanwhile, a wide variety of telecommunications companies are pouring billions of dollars into creating networks using WiMax – a long-range, higher quality version of Wi-Fi – which will be used to beam video, music, and data to mobile devices and computers. New services likely will be able to reach into cars, for decades the almost-exclusive domain of radio. Now many car models are equipped with DVD players and iPod docking stations, in addition to satellite-capable radios.

Wall Street analysts are skeptical about the public's loyalty to radio, despite the industry's claim of vibrant listenership. Studies show that people are using radio fewer days per week, "the only traditional medium showing such erosion," according to research firm Gartner Inc. Even newspapers and TV are holding on to consumers' habits better than radio, according to Gartner. Even though satellite requires a paid subscription, Gartner predicts that satellite radio will have 26 million household subscribers by 2009, while digital radio will only be available in 11 million households.

To succeed at HD, radio broadcasters will have to "re-evaluate [their] most fundamental assumptions" about business models and "use the FM multicast to superserve" audiences, Gartner said. That means local programming and targeted niches, like minority groups, virtually ignored by conventional radio. Some obviously get it. "One thing that sets us apart is localism," Gillmore said.

But the broadcasters are faced with a nasty Catch-22. They don't want to spend money on HD without a clear return on investment, but they won't get any return on investment until they spend money to create and market dynamic programming. With budgets tight, radio companies have spent money on the equipment, but none has shown any willingness to step forward to create original HD programming. No one is close, for example, to suggesting the hiring of a Howard Stern-type name to air only on HD and drive the market. "With budget and personnel cuts now taking place across the industry, it seems unrealistic that more resources are now going to be devoted to multicast stations," Ross concluded.

While $200 million in ad time sounds impressive, the industry is spending very little cash to launch the format. "I think the radio industry, in some respects, is going about this very conservatively," said Kagan analyst Michael Buckley. So far, for example, the HD Alliance has shown a reluctance to subsidize the installation of receivers in cars, something that has helped boost the satellite industry (though also one of the reasons satellite continues to hemorrhage money).

There is a sense that broadcasters are already hedging their bets, viewing HD as a means to an end rather than a savior on a white horse. "In the short term, it's not important to us at all," Gillmore said. After all, the HD channels aren't expected to generate revenue – in the short term – and no significant money will be spent on them. Gillmore looks at HD as part of an overall digital strategy. "I know it's vital that we be more platform-agnostic," Gillmore said. "We're prepared to be where the listeners are."

To KUT's Dean, in the current landscape HD is primarily an excuse to create new channels to stream on its Web site. "If HD radio fails in some way, it's not something that I'm concerned about, because the main audience for HD-2 is online," he said. In addition to the current news channel, KUT will likely debut a digital music channel next year. But KUT probably won't expand its HD programming, Dean said, unless it can arrange specific sponsorship and financial support, the very same dilemma facing the commercial stations.

With competition increasing, pressure will mount for the commercial stations to monetize HD, to wring some sort of revenue stream from it. Temptation will eat at the radio executives, pushing them to make decisions that could ruin their competitive advantage. After the launch period, some will want to put as many ads as possible on the HD channels, threatening to make the new digital channels sound a lot like old radio, while ceding the commercial-free landscape to satellite and the Web. Others will push to add more channels, which would damage the quality of the reception, literally slicing away at the format's technological advantage.

Finding Ears

In the media world, many wonder if the radio industry will be able to make it happen, whether it has the mojo to create a new generation of radio. At its heart, the HD campaign is a referendum on radio's ability to market itself and create new, fun programming. Ultimately, they know they're aiming at a young generation that, studies show, is growing up less interested in terrestrial radio than their parents. HD is seen as a chance to hook them into old-fashioned radio services, before they settle into new habits. "We're looking at doing things to make radio cool for teens," Gillmore said, invoking the c-word.

Several factors could boost the industry's chances. The HD Digital Radio Alliance has already announced plans to up the ad commitment supporting the format to $250 million in 2007. And it has vowed to focus on automakers in the next year, including a new device to convert car radios to HD. In the next year, more manufacturers are expected to include both HD and satellite capabilities into new receiver models for both home and cars, giving consumers a choice. HD could also spark innovation, including new TiVo-like digital recording devices for radio, which might spark people to buy.

Most importantly, the price of receivers is steadily dropping, and a variety of models will soon be readily available for less than $100. When RadioShack put an Accurian tabletop HD receiver on sale for $99 the day after Thanksgiving, sales surged, according to the alliance. "When we reach $100, we will see a real ramp-up in consumer interest," Buckley said.

And then what? At that point, it will still be up to the radio industry to make it work, to offer the public a reason to buy. When HD radios are as inexpensive and ubiquitous as regular radios, broadcasters will face "a renewed responsibility to put on a show for those listeners who do show up," according to Ross.

If they don't, broadcasters must face the very real possibility that the slow ramp of HD channels may simply cannibalize the listenership of their existing channels. If they're unable to grow the number of people choosing terrestrial radio over satellite and the Internet, they will simply be redistributing their listeners to more channels, slicing the pie into smaller pieces instead of growing the pie.

Ultimately, "It doesn't matter; they have got to do it," Buckley said. "They may not grow the pie, but hopefully they can keep the pie from shrinking." ![]()

*Oops! The following correction ran in our December 29, 2006 issue: Due to an editing error, the name of Emmis Communications' Austin market manager was misspelled in the feature "Worldwide Radio Wrestling!" The correct spelling is Scott Gillmore. The Chronicle regrets the error.

Got something to say on the subject? Send a letter to the editor.