Austin Taxes

Too high, too low, just right -- or all of the above?

By Mike Clark-Madison, Fri., Aug. 8, 2003

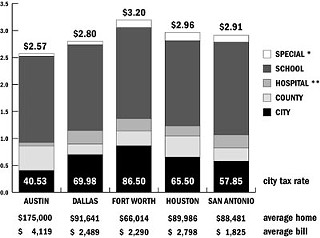

* Vary between cities; in Austin, ACC

** In Austin, the city; elsewhere, a district

Though Austinites pay the lowest tax rate of any major Texas city, our inflated property values leave us with the highest tax bills. However, City Hall gets a smaller piece of the property-tax pie than any of its municipal counterparts -- while the Travis Co. Courthouse takes a much bigger-than-normal bite.

For years now, this reporter has caught holy hell for suggesting that Austinites' property taxes are too low. ("I'm stunned every time you say that," a certain city manager tells me.) But there's no arguing that Austin's tax rate isn't high enough to cover what the city spends; the Austin Police Dept. alone consumes more than the city's annual property tax collections. (Fire and EMS combine to eat the sales tax; everything else in the General Fund -- parks, libraries, health care, planning -- is paid for by transfers from the city-owned utilities.)

After adjusting for the cost of health care -- provided in Austin by the city, elsewhere by a hospital district -- the current city tax rate is nearly 18 cents lower than that of San Antonio, 25 cents lower than Houston, nearly 30 cents lower than Dallas, and 46 cents lower than Fort Worth. If Austin levied as much as San Antonio -- which it did, 10 years ago, before rising property values and tax-averse city councils drove the rate down during the boom -- the city would be bringing in at least $80 million more this year, and there would be no budget crisis.

But such a tax hike will not happen, even if state law made it easy, which it does not. An FY 04 increase of more than about 6 cents would enable citizens to petition for a referendum on rolling back the tax rate. The City Council, most notably Mayor Will Wynn, is already tripping over the 3.3-cent increase -- to the "effective rate" that theoretically leaves the city's total revenue unchanged -- that City Manager Toby Futrell has proposed in the FY 04 budget.

| COMBINED Property Tax Rates, 2002-03 | |||||||||||||||||||||||||||||||||||

| City, County, and other tax rates in Texas' largest cities, and their share of the total tax. Rate is in cents per $100 valuation. | |||||||||||||||||||||||||||||||||||

| City | County | Hospital* | School | Special** | Total Rate | ||||||||||||||||||||||||||||||

| Austin | .4053 | 15.8% | .4558 | 17.7% | .0646 | 2.5% | 1.5964 | 62.1% | .0500 | 1.9% | 2.5721 | ||||||||||||||||||||||||

| Dallas | .6998 | 25.0% | .1960 | 7.0% | .2540 | 9.1% | 1.5875 | 56.6% | .0655 | 2.3% | 2.8026 | ||||||||||||||||||||||||

| Fort Worth | .8650 | 27.1% | .2725 | 8.5% | .2324 | 7.3% | 1.6858 | 52.8% | .1394 | 4.4% | 3.1951 | ||||||||||||||||||||||||

| Houston | .6550 | 22.1% | .3881 | 13.1% | .1902 | 6.4% | 1.5800 | 53.3% | .1493 | 5.0% | 2.9626 | ||||||||||||||||||||||||

| San Antonio | .5785 | 19.9% | .2439 | 8.4% | .2439 | 8.4% | 1.7220 | 59.1% | .1232 | 4.2% | 2.9115

| * In Austin, paid by the city; elsewhere, by a hospital district. | ** In Austin, the community college; each city has different special districts. | | ||||||||||||||||||||||

It's not hard to see why Wynn has cold feet: Even with its low tax rate, Austin levies the highest tax bill of any big Texas city -- over $700 for the mythical "average home" goes to City Hall. Partly this reflects Austin's lack of homestead exemptions, but mostly it's because that average home is worth nearly twice as much here as elsewhere and has increased in value nearly 50% in the last four years. Though declining commercial values have dragged down the total tax roll -- hence the climbing effective rate -- residential values are still going up, if not as fast. The combined average property tax bill is $4,119.

Both Futrell and council members have noticed and admitted the flaws in City Hall's Nineties fiscal policy -- keep taxes flat, spend lots more money, and rely on windfall sales tax proceeds and growth in Austin Energy revenues to make up the difference. (The other city enterprises that make money -- such as the water utility, the airport, or the convention center -- all face fiscal straits of their own.) Now that sales tax has declined for 21 straight months, and AE observers are making unpleasant noises about the power company's long-term fortunes, the battle lines are clear: Either we whack the hell out of city spending, or we raise the hell out of property taxes. Futrell has proposed a little of both -- too little, she concedes, to actually bring City Hall's books into long-term "structural balance," but still perhaps more than the public and council will tolerate.

There is a third option, often discussed but never accomplished throughout several decades of boom and bust: Moving money, or functions, across jurisdictional lines. One example is a hospital district, though that would make money, not save it; proponents argue that what the city spends right now on health care is not enough, and only by tapping Travis Co. taxpayers (and, in the long term, citizens throughout Central Texas) can we actually meet the community's needs.

Though things are slowly becoming more equitable -- for example, with EMS, for which Travis Co. now pays a satisfactory share -- City Hall denizens still often carp about Austin's outsized share of the local government burden. This despite the fact that Austin earns a much smaller share of the combined local tax revenue than do other Texas cities -- 17.2%, compared to between 21% and 28% elsewhere. By contrast, Travis Co. and Austin ISD earn much more, in both absolute and percentage terms, than do their urban peers. For the school district, that's not really apples-to-apples, since Austin ISD is "property-rich" and subject to recapture and may be able to lower its tax rate if we ever again have a Legislature that addresses school finance.

What's the county's excuse? Only Harris Co. -- with its hyperactive criminal-justice system and its vast numbers of unincorporated residents -- takes as big a tax bite as does our own little courthouse. The complaint is familiar: Travis Co. taxes everyone, but does little to serve the 80% of county residents who live within the Austin city limits. (Austin's share of the actual tax roll is even larger.) County leaders respond that they don't have a sales tax or a power company, and that because they grant a homestead exemption, their tax rate is not really higher than the city's. Many are not buying it. "That's where we should be looking for structural balance," says one City Hall insider. "The county earns as much from city taxpayers as does the city itself, and what do we get? A jail."

In what is probably not Toby Futrell's favorite quote of the month, Travis Co. budget director Christian Smith wrote in his budget proposal -- released two weeks ago -- Travis County does not face a financial crisis in FY 04. Moreover, compared to other governmental organizations, the County is in reasonably good financial shape." Good enough, apparently, for Smith to likewise propose a hike (of just under 3 cents) to the effective rate, which is still higher than the city's, but only $7 million in reductions -- a 2.2% cut in the county's General Fund, as opposed to the 10.4% slashing ($38.2 million) Futrell has offered. The county is opening all of its new facilities on schedule, and nobody is getting laid off; positions are being eliminated at the Travis Co. Sheriff's Office because the jail is no longer overcrowded, but Smith expects these to be covered by attrition. However, Smith notes that county commissioners "have publicly declared a strong desire to reduce the tax rate proposed ... by between 1.5 and 3 cents." That would mean $9 million to $18 million more in cuts. It would also make it difficult for the commissioners to discuss cost-of-living raises for county employees, including peace officers, which Smith (like Futrell) has omitted from his proposal.

Got something to say on the subject? Send a letter to the editor.