City Budget: Room to Move

Council nears final decisions on 2019 budget

By Michael King, Fri., Sept. 7, 2018

City Council gathers today, Thursday, Sept. 6, for a special called budget meeting, hoping to give final shape to the fiscal year 2019 budget. The official budget "readings" are next week: If things go quickly, that should mean budget adoption on Tuesday, Sept. 11, with the two following days as contingency if last-minute amendments remain unresolved.

Thus far, matters have proceeded fairly smoothly, with few substantial changes from the budget proposed Aug. 6 by City Manager Spencer Cronk, and more flexibility in the numbers than has been available in recent years. The initial budget numbers ($4.1 billion in All Funds, roughly $1 billion for General Fund operations) continue to ground the conversation, although minor changes remain in play.

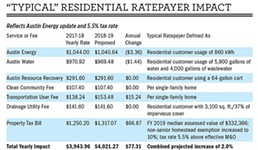

That proposed budget initially anticipated an overall 2% increase in taxes and fees – moderate by recent standards. Then last Wednesday, Aug. 29, staff reported a late-breaking bit of better news. Austin Energy's rate change came in lower than expected, when state "tariffs" (pass-through expenses) did the same. The projected $2.76 annual increase for the "typical" median homeowner became a $3.36 reduction (that is, $6.12 lower than estimated).

So, for the first time in memory, Austin Energy and Austin Water are both projecting slight rate decreases, allowing the total projected residential tax/fee increase to drop as well – if nothing else changes, at an annual $71.92 (or 1.8% instead of 2%). Don't count the six-bucks-a-month so quick – based on the dais discussions, Council is likely to raise the property tax rate by 6% (over the staff-proposed 4.9%), both to add some rainy day spending, and in anticipation of another attempt by the Legislature to lower the 8% rollback cap on property tax increases. Tentative discussions suggested they would simultaneously increase the senior/disabled homestead exemption (currently $85,500), in order to hold harmless those categories of homeowners.

None of that is settled yet, although earlier last month Council set the "maximum" rate increase at 6%, and various budget amendments are pending that would indeed push the draft rate of 4.9% to 6% or close to it.* In discussions last week, both staff and Council members pointed to the need for long-deferred facilities maintenance (especially in Parks) and for the joint (with Travis County) Integral Care Expanded Mobile Crisis Outreach Team (EMCOT). The EMCOT program, currently funded through a Central Health Medicaid waiver, has substantially reduced the number of arrests for people needing emergency mental health care, rather than incarceration. But the feds have changed the rules governing that money – meaning that if it is to continue, county commissioners and Council will need to ante up.

Even beyond these real needs – and there are other potential amendments queuing up behind them – the anticipation of a Legislative crackdown on municipal taxation has created a perverse incentive for cities to raise taxes higher now, as a firewall against any future cap on rate hikes. The current cap ("rollback rate") is 8%; in 2017, the Lege failed to enact a proposed 4% cap, so Gov. Greg Abbott and his allies are now proposing to lower the cap even further, perhaps as low as 2.5%. If your future financial flexibility is calculated upon a capped rate – it makes sense to go higher now, enabling future calculations to be based on that higher revenue.

If you need any additional motivation to vote in November, that cockamamie Capitol threat should provide it.

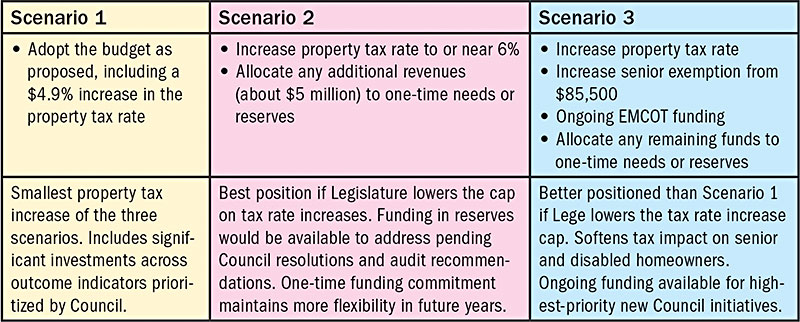

Anticipating these choices, staff prepared for Council three potential "scenarios" for their consideration in making final decisions (see chart). Under the first scenario, Council would simply accept the city manager's proposed budget, and stick with the 4.9% rate increase. Under the second, Council would increase the rate to or near 6% and move the additional funding (estimated at about $5 million) to a mix of reserves or one-time expenses. Under the third (and most likely) scenario, Council would raise the rate, direct some of the additional funding to deferred maintenance and EMCOT ... and either reserve the rest or parcel it out to other programs.

Those choices will play out over the next few days, with final budgeting decisions (and adopted tax rate) to be formalized next week.

*"the draft rate of 4.9% to 6% or close to it": this passage has been revised to clarify the potential rate changes.

Offers on the Table

Additional highlights from the proposed budget

• Housing Trust Fund: adding $3.3 million, making it fully funded (at $5.3 million) for the first time

• Homelessness: $3.1 million in new funding ($29.4 million total)

• Fire Stations (2): Moore's Crossing (southeast) and Travis Country (southwest)

• Police: 33 additional officers/equipment ($5.7 million)

• Mobility Bonds: $68 million (capital spending) for corridors, sidewalks, bike lanes, trails, safety

• Historic Preservation: $11.2 million (full 15% allocation from Hotel Occupancy Tax)

• Aquatics Maintenance: $1.8 million ($10.7 million Aquatics activity funding)

Potential Budget Scenarios

Got something to say on the subject? Send a letter to the editor.