The Hightower Report

Wall Street and Washington: Here We Go Again; and J.P. Morgan Creates Jobs With Bailout Money

By Jim Hightower, Fri., April 24, 2009

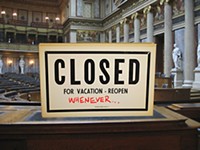

Wall Street and Washington: Here We Go Again

One thing we've learned from the Wall Street manipulators is that they are about as trustworthy as a wolf's smile.

In their world of financial hocus-pocus, "up" really means "down," and "trust us" should be interpreted as "run for the hills!" Semantics become weapons when in the hands of bankers, so beware of a one-word change that Wall Street lobbyists recently got banking regulators to make in an arcane accounting rule.

The rule, called "mark-to-market," has now become "mark-to-management." This seemingly minor change allows banks to hide the true value of the assets they have on their books. By making their assets seem to be worth more than they are, a bank can make itself look healthier and better run than it is. Think of it as cosmetics for bankers.

Specifically, they wanted to hide all those bad housing loans that they have on their books – loans so bad that they're referred to as "toxic assets." Under the mark-to-market rule, banks were required to "mark" the value of each of these home loans according to the actual market price of each house – prices that have plummeted since the loans were made. Rather than report such real losses on their books, the financial giants demanded that the rule be changed.

Thus, market-to-management. Now the management of the bank is allowed to mark the value of the toxic assets on its books at whatever price management says they're worth. In other words – hocus-pocus – Wall Street's financial wizards can call a tadpole a whale. Under intense lobbying from the banking semanticists, Congress recently forced regulators to go along with this fiction.

Excuse me for noticing, but wasn't it Wall Street's perversion of reality – along with Washington's acquiescence to deregulation fantasies – that got us in today's mess? We're not even out of the current mess – yet there they go again, creating another one.

JPMorgan Creates Jobs With Bailout Money

For us populist commentators, the Wall Street bailout is a gift that won't stop giving. I'd really like to give it a rest – but the bankers won't let me!

The heads of these financial giants are not merely greedheads but also boneheads – completely clueless about the public's moral outrage over their self-serving actions. The latest to send my O-Rage meter into the red zone is JPMorganChase. So far, we taxpayers have delivered $25 billion to this outfit. To show their gratitude,

JPMorgan honchos recently announced a new program of job creation, which would be absolutely splendid – except they're sending the jobs to India.

Excuse me, but wasn't this bailout meant to stabilize our economy? More than 4 million Americans have gotten pink slips in the last year, and unemployment now tops 10% in seven of our states – yet, rather than putting people to work in, say, Indiana, Morgan intends to outsource tens of thousands of its banking jobs to India.

As part of the bailout, this Wall Street giant took over two other big banks last year, and it is now merging the information technology functions of all three institutions into one. These are potentially good jobs that would pay middle-class salaries in our country. However, the chief information officer of JPMorgan says the tax-supported merger gives the bank an opportunity to increase its outsourcing to India by 25%. The bank can get Indian workers to do these jobs for a third to a half of what it would pay Americans, then pocket the wage savings to fatten its corporate bottom line.

Morgan could also get half-priced bank executives in India, but, curiously, it shows no interest in that move. Shouldn't our bailout officials find us some bank managers who care about something bigger than their own self-interest?

For more information on Jim Hightower's work – and to subscribe to his award-winning monthly newsletter, The Hightower Lowdown – visit www.jimhightower.com. You can hear his radio commentaries on KOOP Radio, 91.7FM, weekdays at 10:58am and 12:58pm.

Got something to say on the subject? Send a letter to the editor.