Naked City

Home Improvement?

By Kevin Fullerton, Fri., Dec. 3, 1999

East Texas developer Don Sowell came to the Nov. 15 Texas Dept. of Housing and Community Affairs board meeting expecting routine approval of tax-credit subsidies for an apartment complex he had proposed in Houston. Instead, Sowell was detained at the podium for more than 10 minutes while the three-member committee which oversees low-income housing tax credits reviewed program compliance problems at Sowell's existing properties.

Board members seldom fuss publicly over the details of projects put before them for approval, so why all the fanfare this time? Because the state Bond Review Board had sent notice to TDHCA that it wouldn't approve the issuance of bonds to finance Sowell's development until the housing agency provided more information about Sowell's noncompliance issues. Sowell, whose company manages an number of affordable rental properties built with state-issued subsidies, was singled out in a recent Chronicle article (Oct. 22, 1999) as a developer who annually wins tax-credit awards despite a record of outstanding program violations.

TDHCA director Daisy Stiner said at the meeting that Sowell's violations, which include 11 properties which have fewer than the required number of low-income tenants, and 37 late submissions of compliance documents, were considered "immaterial" by TDHCA staff because they were "correctable." Stiner added that some problems could be attributed to previous owners and TDHCA compliance recording errors. "These kinds of things can be misinterpreted" by a novice, Stiner said, "but we're not making light of the fact that we do have these noncompliance issues. We wish we didn't have them."

Two weeks ago, Stiner sent a spreadsheet to the Bond Review Board showing that correction was in process at all noncompliant Sowell properties. The TDHCA tax-credit subcommittee approved Sowell's Houston development, with only committee member Lydia Saenz voting no, and the Bond Review Board, which consists of the governor, lieutenant governor, House speaker, and comptroller, assented a few days later. However, Jeanne Talerico, a program administrator at the board, said her agency plans to require similar checks on developers in the future.

Members of the House Urban Affairs Committee, meanwhile, are proposing changes to the rules governing the housing agency's tax-credit selection process, hoping to dispel confusion about which developers' projects deserve the subsidies. State Rep. Harryette Ehrhardt (D-Dallas) announced at the TDHCA board meeting that a work group of housing industry professionals assembled by her office had drafted amendments to the agency's qualified allocation process, or QAP. The QAP revisions suggested by the group would more tightly define "material" grounds for disqualifying tax-credit applications. For example, the new rules would state unequivocally that developers who fail to satisfy all threshold eligibility requirements by a certain date would be terminated, prohibiting, as the drafters note, "applications that evolve continuously ... in some cases, past the filing deadline." TDHCA staff have been accused of allowing certain developers to fix their applications during the selection process.

The new rules would also strike out the controversial provision in the current QAP which permits TDHCA officials to subjectively choose lower-scoring projects over higher-scoring ones based on geographic preference. Instead, officials would have to submit a written justification for choosing any development over others which scored higher. Another proposed change would add language emphasizing that the agency is not required to choose inferior projects over better ones just because the projects are competing in different funding categories.

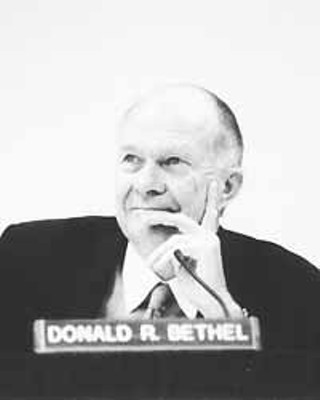

TDHCA board chair Don Bethel says he won't comment on the proposed QAP changes while they're in the public input period. But he did say that he thinks some revision is appropriate, and that he "look[s] forward to making changes in the QAP, hopefully for the better."

Also at the Nov. 15 meeting, board member Florita Bell Griffin announced that she had filed a $25 million claim in an ongoing lawsuit against Fort Worth developer Kenneth Mitchell for making "defamatory statements that suggest Griffin is guilty of criminal action" to a TDHCA board member. The claim, filed in May, says that Mitchell told the board member that Griffin was a "blind shareholder and beneficiary" in a controversial tax-credit development in Bryan for which Griffin has been investigated by the FBI.

Mitchell arrived at the meeting to find that he was not on the board's agenda for final tax credit approval, even though the closure deadline for his project is in early December, before the next TDHCA board meeting. Mitchell says he applied to appear before the tax-credit committee by the required filing date and was never informed by the agency of any obstacle that would prevent his project from being considered that day. When Mitchell threatened to take the podium and present his project anyway, Stiner intervened and added him to the agenda, Mitchell says.

Got something to say on the subject? Send a letter to the editor.