https://www.austinchronicle.com/screens/1999-03-05/521524/

Internet Outlaw Michael Wolff Shoots Straight

By Jon Lebkowsky, March 5, 1999, Screens

-- Michael Wolff on the Internet, Burn Rate

|

|

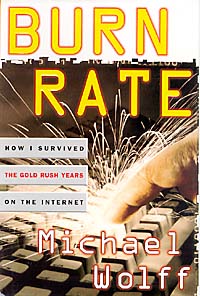

These days, the Internet is starting to have shape and substance and is becoming a Big Deal. Wolff's book hit just as the rest of us began to hear the People Who Should Know describe the Internet as an industry; Wolff created even more of a buzz with his concise descriptions of players and meetings. Although these are the kinds of topics which can be pretty boring, the combination of Wolff's dry wit and his eye for significant detail makes for a good read. Even people who hate the book seem to love reading it.

Many speculate that Wolff couldn't possibly retain the detailed memories of all those business meetings he describes in Burn Rate; but regardless, he presents a pretty accurate picture of the scramble to make a viable industry from a technology that nobody has quite figured out. Now Wolff is doing the pundit thing, trying to make informed guesses about the future of media old and new, and he will be one of the keynote speakers at this year's South by Southwest Interactive Festival.

|

|

Austin Chronicle: Were you surprised at the ruckus over Burn Rate?

Michael Wolff: Gratified is more like it. It's nice to hit the target.

AC: In some commentaries on the book, your credibility was questioned. People doubted whether you could actually remember accurately all the stuff you wrote about. Were you in fact carrying a poetic license as you wrote?

MW: Everything in the book is accurate. That's the way it looked from where I stood.

AC: The subtitle of the book is "How I Survived the Gold Rush Years on the Internet." Don't you think this was a bit premature? Isn't the real gold rush happening now?

MW: Well, it does seem to keep going on and on.

AC:Does the acknowledgement of the Internet as an industry and the stock market frenzy over Internet companies give you a different perspective on the events mentioned in the book?

MW: It merely confirms my view of the Internet world as being a) without logic, and b) the playing field of speculators and financial engineers.

AC:In the Dec. 28 Industry Standard, you wrote that the AOL model would kill the distinction between the Internet we all knew and loved and ordinary life "not with a bang, but with a whimper." Do you think the "computer underground" and hacker subcultures will be erased, or will they merely be driven further undergound?

MW: I think they will be erased.

AC:At the end of the same piece, you said you'd be "pursuing the next chapter of the Internet story from a vantage point outside the technology business." Are you ready to unfold that mystery?

MW: Really no mystery, just one magazine not wanting to trumpet another. I'm not writing a weekly column for New York Magazine about the media writ large (i.e., old media as well as new media).

AC:(Techno)cultural critic Mark Dery has argued that the long boom/Peter Schwartz/Kevin Kelly/Tom Peters view of a rosy future mediated by technology stands in stark contrast to a reality in which "we're witnessing a dizzying upward redistribution of wealth and the massive consolidation of multinational megaconglomerates in seemingly every industry, from book publishing to magazine publishing to newspaper publishing to the funeral industry." This brings two questions to mind: Is this the reality you're seeing? Do you think it's a bad thing?

MW: Yikes! What a question. It's so large that every answer is right. It is both the state of things and not. Obviously that is one of the trends that we're witnessing, but the question presupposes that corporate string pullers know what they're doing. So: Yes these things are happening; no, they won't work the way they're supposed to work. In fact, I think you can argue that it is chaos rather than control that is increasing.

AC:In a recent interview, you discussed Silicon Valley and the question of whether Austin could fall into the same sort of trap as Silicon Valley. ... Did you actually work in Silicon Valley?

MW: I was just a commuter.

AC: How do you think Silicon Alley in New York compares to Silicon Valley, and to what you've been hearing about Austin?

MW: It's kind of like how the little league compares to the major leagues. There really is no comparison. Silicon Valley is a place with a level of capital that is almost incomparable, and I think any comparisons to it are highly problematic. Nothing is now like Silicon Valley. Could it be replicated? Well, the interesting thing about technology is how fast the shifts occur. But the concentration of capital there, in a capital-intensive industry (because the industry doesn't make money, so you have to have access to capital markets) is what has made Silicon Valley Silicon Valley. Unless there is some other geographic region that is suddenly capable of turning the faucet and releasing just a torrent of capital, it's pretty hard to compete.

AC:Why do you think Silicon Valley was able to aggregate so much capital to turn into its technology companies?

MW: I guess it's partly just the luck of the draw. There were a number of companies that got started there that were successful, there are universities in that area that started to attract talent, there were investment companies that began to make bets in that area, and those investments paid off. So it's a whole kind of cascade of cause and effect.

AC: So as an East Coast guy, do you have the sense that the East Coast investors have resisted investment in local initiatives to build technology, especially new media, companies?

MW: Yeah. New York City is not a place that has a lot of venture capital firms. It has other kinds of money, other kinds of investment, but not the kind of investment that technology usually demands. Also New York City, remember, has big companies. We have real companies. It's very hard to suddenly say, "Hey, let's stop concentrating on our real economy, and let's go focus on an economy which may never return real profits." Plus, New York City hasn't had the kind of technology talent resources that other places with technically minded universities have. So in some ways, from a technology standpoint, everyone's always said New York is kind of a "dumb" town. And I think that's still largely the case. Now, the thinking was always that, as this became "new media," with the emphasis on the media, that content would come out of New York as it traditionally has. But I think the problem with that is that new media has not really turned into media. It's turned into something we-don't-know-what-it-is. But the demand for content has not been all that great.

AC:New York attorney Lance Rose has proposed that the Internet should be seen not as a medium, but as an environment in which diverse media can grow --

MW: I have no idea what that means.

AC:I think what he's saying is that you can't say that it's like television broadcasting, or radio broadcasting, or film, or whatever, but that it encompasses many ways of delivering content, and it's also highly interactive, which none of those others are.

MW: Well, that may mean that it's not media at all; that it's just distribution. If that's the case, and I think that it's certainly partly the case, then there is never going to be a business of Internet content per se. The Internet just becomes something to move a lot of other traditional kinds of content.

AC:Which is what you've been saying anyway, that we've gotten past the technology.

MW: Yeah, that may or may not be true, but it's certainly, I think, a cogent way to look at it.

AC: Do you foresee a real bust, a complete downtime for the Internet industry?

MW: Of course. I don't think anybody except the most chamber-of-commerce-centric people imagine that there won't be a bust.

AC:Are we looking more at what will happen to Internet stocks? Or do you think that there's still not a business model that is sufficiently robust to weather that kind of downturn?

MW: Well, we certainly know that there is not a business model that's robust enough to survive any kind of downturn. As soon as the "endless" source of capital dries up, the business is in trouble.

AC:How about e-commerce as a business model?

MW: I don't know of an e-commerce company that makes money. The e-commerce business model is now: "I will spend more money selling you something than you pay me to buy it."

AC:I tend to think that, in creating e-commerce projects, people get focused on the technology for displaying their wares, and less focused on the processes of fulfillment.

MW: I guess in some cases. In some cases, I think fulfillment is pretty good. Nevertheless, I do think we're still in a situation where things have to be highly discounted, and effectively, you lose money on everything you sell.

AC:And you're beginning to write now about more traditional forms of media as well as new media. Do you see a convergence? That's sort of a Holy Grail or myth or whatever, but I wonder at its potential, especially with broadband access proliferating.

MW: I do see a convergence. I think the question is what form that convergence takes. I wrote a column recently in which I hypothesized that a good deal for AOL would be to buy CBS. The convergence I imagined there was a convergence in advertising packages. The whole movement in the advertising business is packaging media. It's impossible to reach a 1965 network-size audience anymore, so in order to do it, you have to do it across lots of different platforms. If you only have one platform, that's going to be fairly limiting. If you're a media company with multiple platforms, you're ahead of the game. So I conjecture that, if AOL truly wants to be a media company rather than just an Internet access company, then they would have to require other forms of media.

Copyright © 2024 Austin Chronicle Corporation. All rights reserved.