Texas Lege Preview: The Lege Has More Cash Than It Wants

Unprecedented $33 billion surplus puts conservatives in a bind

By Mike Clark-Madison, Fri., Jan. 13, 2023

Not all of Texas' problems can be solved with money (like the incompetence of multiple key state officials), but more money would go a long way to fix what's broken: the power grid, the foster care system, much of the health care system, most state agencies' technology, and more. So an unprecedented budget surplus could make a whole bunch of stuff better, right? Sadly, that's not how state government works.

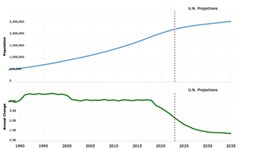

The Texas Constitution caps the amount of money the Lege can appropriate in any biennium, based on the Legislative Budget Board's estimate of the state's economic growth. The LBB, led by House Speaker Dade Phelan and Lt. Gov. Dan Patrick, has thus set the cap at about $12.5 billion. Last August, Gov. Greg Abbott promised he'd use half the surplus (then estimated at $27 billion, now up to $32.7 billion) on property tax relief, but he can't do that unless the Lege votes to bust the spending cap. That only requires a simple majority vote, but it's a third-rail issue for many conservatives, so it's anybody's guess whether it can happen this session.

Where did this windfall come from? It's largely from increased sales tax collections because of inflation, augmented by the federal COVID relief and infrastructure dollars that are still allowing the state to decrease its own appropriations. The state's rainy-day fund is already full to overflowing, so this is an opportunity for the state's financial gurus, led by Comptroller Glenn Hegar (the state's most competent official), to get creative. "It's a good quandary to have," Rep. Donna Howard, D-Austin, who sits on House Appropriations, told the Chronicle. "But it's going to require those who are really smart about the budget to help us figure out how best to do that."

Hegar has floated the idea of creating an endowment fund with some of the surplus that can be tapped to cover the state's underfunded pension liabilities to its retirees, which are quite large. Democrats have pointed out that the easiest way to provide meaningful property tax relief would be for the state to spend more on education and infrastructure, the two most significant burdens borne by local governments and their taxpayers.

Got something to say on the subject? Send a letter to the editor.