The Six Percent Bounty

By Michael King, Fri., June 12, 2015

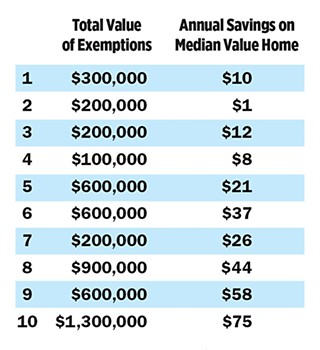

Estimated "Property Tax Relief" by City Council District Under 6% Homestead Exemption

On June 4, City Council voted 7-4 to approve a 6% property tax homestead exemption for FY 2016. The exact value of the exemption will depend on the overall property values prepared by the Travis Central Appraisal District (still to be certified) and whatever property tax rate is set by Council in September. However, in mid-May, city budget officers presented to Council a district distribution estimate, with a potential "revenue neutral" rate of 48.24 cents per $100 valuation (the original forecast rate was 47.50), and a citywide median home value of $227,272. Median values as well as total homestead property values vary widely by district. Using those estimates, budget analysts calculated the following values of the exemption by district, and for median value homes within each district.

Note: The tax savings realized for the "median value homeowner" in each district depends on the median value of homes in that district. In District 5, for example, it's estimated at $201,592, and the 6% exemption yields an estimated annual savings of $21. In District 6, the total exempted homestead value is the same as District 5 ($0.6 million), but the median homestead value is higher ($277,476), yielding an annual tax savings of $37.

Posted here is the entire budget presentation, “General Homestead Exemption, Overview and Analysis” (presented May 13, 2015).

Got something to say on the subject? Send a letter to the editor.