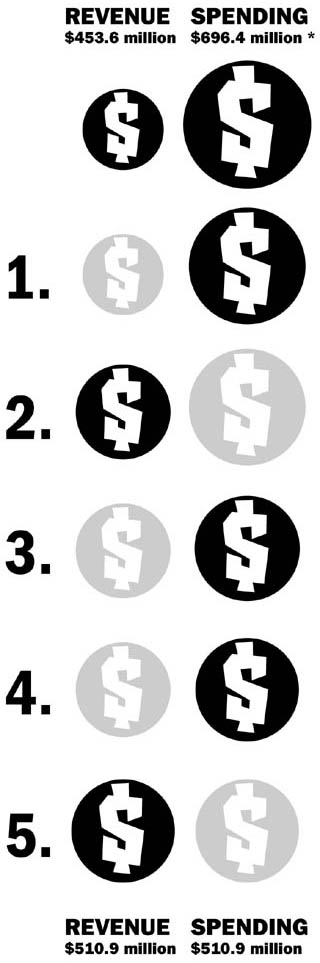

Balance the Budget (In Three Years) in Five (Not-so-Easy) Steps

It will take both unpleasant tax hikes and spending cuts to balance the city budget -- and not until 2006

Fri., May 30, 2003

*$555.7 million + $160.7 million prior-year deficits

The Starting Line

According to City Manager Toby Futrell and her budget staff, we haven't yet seen the worst of the city's fiscal crisis, and if we do nothing to bring City Hall's books into "structural balance," by fiscal 2006 the General Fund will be more than $220 million in the red, a deficit of more than 50%. That will never do, of course. Here's what Futrell & Co. have suggested to the City Council, to balance the budget not just for this year, but for the next three years:

Step 1: One-time funds

Use cash reserves and beginning-fund balances -- a total of just under $60 million over the three years. That helps a little in the short run, but only reduces the FY 06 deficit to $202.9 million. (Since they're one-time funds, we've shown this, as the city does, as reducing spending rather than increasing revenue.)

Step 2: The effective rate

That's the property-tax rate that (more or less) brings in the same amount of revenue as the prior year -- since Austin appraisals are going down (especially for commercial property), the effective rate is going up. Setting taxes at the effective rate each year reduces the expected FY 06 deficit to $124.1 million and will still leave Austin with the lowest tax rate (but, thanks to the boom and its effect on appraisals, the highest tax bills) of any Texas city.

Step 3: FY 04 spending cuts

If we use one-time funds and go to the effective rate, we can balance next year's budget (FY 04) with $24.25 million in spending cuts. If City Hall doesn't restore that spending in succeeding years, that will bring the FY 06 deficit down to $51.35 million.

Step 4: Put off new facilities

Most of the projects of the 1998 bond program -- 80% of the total cost -- are either required by annexation agreements or already under construction. But Futrell is strongly considering deferring construction of the remainder to save the cost of operating them in future years. (Of course, advocates for those facilities -- including branch libraries and rec centers -- don't much like this idea.) This would reduce the FY 06 deficit to $44.45 million.

Step 5: Bigger tax hikes

With step four in place, it would still, according to Futrell & Co., take property-tax hikes in both FY 05 and FY 06 up to the "rollback rate" -- the rate beyond which voters could petition for an election to roll back the tax rate. The rollback rate is determined by the effective rate, but this would mean about a 10% tax hike over two years. Without deferring the new facilities, the forecast goes, City Hall would have to go beyond the rollback rate in FY 05, for a combined two-year tax hike of closer to 15%.

Got something to say on the subject? Send a letter to the editor.