'Simone' Premieres -- at the Credit Union

By Brant Bingamon, Fri., Sept. 20, 2002

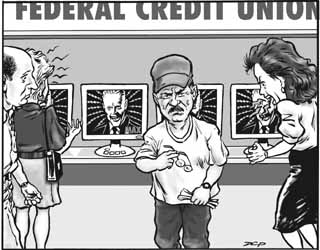

Banking services have taken on a futuristic, Jetson quality at three University Federal Credit Union locations, with the recent installation of remote teller systems -- inside the buildings. The "virtual" or "video tellers," as they are variously called, unite computer and pneumatic-tube technologies with two-way audio and video systems in blond wood cabinets. While official credit union sources say the smiling faces on the other side of the camera belong to actual human beings, talking to them by telephone is a little techno-surreal, something like an up-close-and-personal with onetime TV cyber-being Max Headroom -- or maybe the new digital cinema creation, "Simone."

In operation, the UFCU's virtual tellers perform similarly to drive-through banking. To deposit or withdraw money, a customer fills out a slip and places it into a tube cartridge, which is zipped pneumatically to a human teller in a separate building, who then activates the video hook-up and appears on the screen. The customer can show her driver's license to the teller via the two-way video, or pick up the phone to communicate private info. At the conclusion of the transaction, the money or receipt returns to the customer.

Dan McIntyre, senior product manager for Diebold Inc. -- which has a virtual monopoly on the virtual teller market and installed the UFCU's systems -- says the primary advantage of virtual tellers is security. "The assets are removed from the lobby," he said. "All you have in your lobby is a television monitor, a pneumatic terminal ... there's very little value from a would-be hold-up person's perspective." Of Diebold's 200 virtual teller clients across the country, not a single one has been robbed, he added.

A less obvious but more immediate advantage for customers, McIntyre says, is that "productivity" is improved and customers get quicker service; each human may control from two to eight terminals. Virtual tellers also take up less space, so businesses can operate in smaller, cheaper buildings. And one more contemporary touch, already in relentless operation at the UFCU: The financial institution can advertise its services (not to mention those of potential sponsors) on the screen, while the human teller processes an order. The captive "customer" can do little else but stare at the screen. Credit union representatives deny that issues of productivity or marketing entered into the decision to install the virtual tellers, and say no one has been laid off because of the change.

However commendable the new systems may be, UFCU's directors are not eager to discuss them. After an initial invitation for a reporter to drop by and chat, bank administrators said only President Tony Budet could be quoted on the subject -- but that Budet wasn't interested in talking. Photographs of the machines were disallowed on the grounds that they would pose a security risk, although large glossy posters showing the cabinets are on display at UFCU locations.

Budet finally relented, and emphasized that customers uncomfortable with the new technology will still have access to human beings. "What I tell members is that we will do business with them any way they prefer," he said. "We offer face-to-face service in our lobby, we always will, and for those individuals who actually prefer to access service on a personal basis, they will certainly have that opportunity." Praising the enhanced privacy the systems' phone lines offer, and stressing their security record, Budet says virtual tellers will be installed in the four remaining UFCU branches during future renovations.

Virtual tellers are becoming standard among Texas credit unions, Budet said. Greater Texas Federal is said to be adding them. But not everyone is moving in that direction. Anne Boatright, president of Capitol Credit Union, says her members have little interest in the machines. "I think they really like coming into the office and just talking to a real, live person," she said. "At least that's the feedback we've gotten from our members. And we like getting to know them."

Got something to say on the subject? Send a letter to the editor.