What I Learned at the Dot-Bomb Revolution

Former "Chronicle' Staffer Wipes Out on the Great Cyber-Wave and Lives to Tell About It

By Robert Bryce, Fri., Nov. 30, 2001

The offer was just too good.

Interactive Week magazine offered me $85,000 a year to write about Internet business and technology. Although my knowledge of the tech industry was limited, I jumped at the chance -- and the cash. Moreover, after a decade of covering politics -- culminating in the November 2000 elections featuring the vacuity of George W. Bush, the blandness of Al Gore, and the Supreme Court's 5-4 foray into electoral politics -- I was longing for something different, something that didn't include politics (at least of the conventional sort).

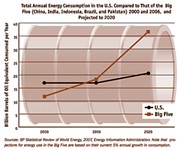

The editors first called to talk about the job in mid-December. They'd liked the freelance technology pieces I'd written for Interactive Week, both of which had focused on energy usage and the Internet. In mid-January, they flew me to New York for an interview with the three top editors at the magazine, putting me up at the Hotel Giraffe, a swank midtown place a few blocks from their office. By the time of my interview, I was ready: I'd spent days thinking about stories I could pitch, topics that I thought the magazine should be covering, and about my strengths as a journalist.

I liked the editors. Editor in Chief Rob Fixmer had spent the previous few years at The New York Times, where he'd edited the first piece I'd had published there. John McCormick, the second-in-command, was a no-nonsense tech guy who'd spent most of his career in technology publishing. Executive editor Jeri Clausing, my initial contact at the magazine, was also a Times refugee. We had bumped into each other at a party in August of 2000, and when she learned that I wrote freelance, she encouraged me to send her some ideas. They sold me on the magazine, explaining that it was among the oldest and most respected trade magazines in the sector. Plus, they said, it was the most profitable magazine in Ziff Davis Media's stable.

After a few meetings and lunch, we sealed the deal. The next day, they sent me an offer letter, with the $85,000 salary in bold face print. I gave two weeks' notice at the Chronicle and began reading everything I could about the Internet and technology.

Although I worried, like any writer in a new job, the new gig was great. I worked out of my home office. Ziff Davis, which owned Interactive Week and a dozen other tech-oriented magazines, sent me a spiffy new IBM laptop with a detachable base unit. They paid all my phone bills. They encouraged me to attend technology conferences (although I soon discovered I was working so much I never had time). The editors were enthusiastic about what I was writing. They sent me to San Francisco to do a story on McKesson, the giant drug distribution company. They had me write a feature story on IBM's Internet initiatives -- a daunting but eventually rewarding task, given the enormity of the company. They sent me to Detroit to write a story (which never did get published) on how General Motors was using the Internet to cut costs and speed production times.

After a few months on the job, convinced that my bosses liked what I was doing, I asked Fixmer to see if he could secure for me some stock options in the company. On June 13 (I still have the e-mail) he wrote saying yes, I had been granted 5,520.67 options on Ziff Davis stock. Although the entire industry was faltering, I figured that in a few years, Ziff Davis would go public and maybe, just maybe, those options would be worth something.

I survived two sets of layoffs at the magazine -- one in May and another in July. Although I was sure that as the last one hired I'd also be the first fired, the magazine laid off about a dozen other people, including half a dozen writers who knew a hell of a lot more about technology than I did. Just after September 11, Ziff Davis closed its travel magazine -- most people figured it was through with the cutbacks. The company's CEO at the time -- Avy Stein, the head of Willis Stein & Partners, the venture capital firm that owned Ziff Davis -- even promised all the employees that there would be no more closings or layoffs. "We are in growth mode," Stein said.

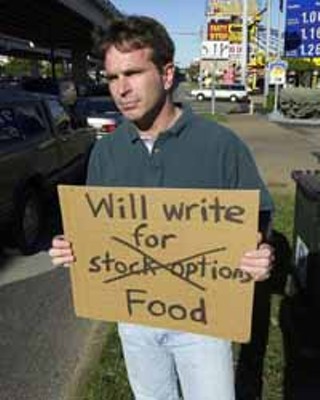

On Nov. 5, all of us at the magazine got the axe. No warning, no explanation, no discussion. Send back the new laptop. Sign this letter. You'll get six weeks of severance. See ya.

So, although I'm now back to freelancing, I learned a great deal while covering what was probably the worst nine months in the history of the technology industry. The following are a few instant notions, idle speculations, snap predictions, and considered judgments to ponder while we all wait for Happy Days to Return to Silicon Hills.

The Net Hype Wasn't All Wrong

Given that I just got dumped on my ear by a trade magazine that focused on the Net, you might assume that I'm bearish on the Internet. Wrong. Sure, the hype about Web sites like Living.com and lots of others was overdone. So what? The bottom line is, the World Wide Web is changing our lives in dramatic ways -- and it's not just about buying CDs from Amazon. The Internet is giving more and more information, to more people, at low (or no) cost. That is an unqualified good. It's also good for democracy.

Several economists have argued that the Web is the most deflationary event in America since the advent of the railroads. Like the railroads, the Net is increasing the speed of goods to market, increasing efficiency, shrinking time and space, and giving ordinary people access to events, communication, and goods previously out of reach. Those are good things. And moderate deflation can be a good thing. In a deflationary environment the price of bread -- thanks to efficiencies in the economy, productivity gains, surpluses, etc. -- falls. Instead of costing $1, a loaf might cost 80 cents. Ultimately, that is one of the greatest economic goods that can be bestowed upon ordinary people: the ability to have their spending power increase without having to work harder.

The Net has also become an important democratizing force. Since the times of Gutenberg, free speech has been guaranteed only to those who own a printing press. Now, with the Internet, anyone with access to the Web has the virtual equivalent of a printing press, with the ability to send and receive information from almost anywhere to almost anywhere. That's why countries like China, Cuba, Singapore, and Saudi Arabia, as well as nasty regimes like the Taliban, want to limit access to the Web: An ignorant citizenry is easier to rule.

The first rule of the Information Age is that information wants to be free. The Internet helps make information -- and people -- free.

Business People Are More Honest Than Politicians

In the years of covering politics, I've heard dozens of speeches about how a politician wants to do something "for the children." Oh, and there were the widows, orphans, over-taxed-under-appreciated-you-name-it-faction-that-needs-special-attention-this-week. For the past nine months, I've dealt with businesses and tech people who had only one goal in mind: They wanted to make money. And they were (usually) able to say very quickly why the market needed their gizmo. That was refreshing.

B2C Is Growing -- But B2B Is Where the Action Is

Yes, Amazon is a big deal. And yes, more and more companies are selling goods and services on the Net.

But the real push these days is in the business-to-business world. Companies in every sector are looking for ways to interconnect their computers with those of their peer companies, so they can exchange information easily and quickly. While much of this activity is invisible to consumers, it will have significant effects over the long term. For instance, General Motors and other carmakers are interconnecting their design operations with those of their suppliers. In the next few years, that kind of integration will allow consumers to order a new Chevy Suburban with every custom feature imaginable and have the car delivered in two weeks instead of two months. And the car's price will be as low or lower than it is now, because the carmakers have been able to save money during the design and production process.

The carmakers will integrate their computer systems with their suppliers' systems with software that uses open standards with acronyms like SOAP, UDDI, and WSDL. But the most important standard is Java, the open source software code developed by Sun Microsystems.

Which leads me to my next point.

The Future Is Java and Linux

Microsoft isn't going away. Regardless of what the Department of Justice and the state attorneys general decide to do, the behemoth from Redmond has enough cash on hand -- about $32 billion -- to last through several recessions and dozens of federal lawsuits. Like it or not, Microsoft will rule the desktops used by our grandchildren. Software like Word, Excel, and Powerpoint have become the de facto standards of the business and consumer world, and nothing short of an armed revolution, followed by an earthquake, followed by the second tour of Noah's Ark, will break Microsoft's death grip on those applications.

But that doesn't mean Microsoft is invincible. Although Microsoft will rule the desktop, its bid to rule the Internet, with a series of proprietary software programs called .NET, will fail. There's simply too much momentum behind Java. The beauty of Java is that it can be written one time and run on any kind of computer, regardless of the underlying operating system. Microsoft's .NET doesn't have that flexibility.

The same forces that are pushing Java -- namely, the large number of programmers and corporate entities who demand flexibility and don't want to be beholden to Microsoft -- are pushing Linux. Popular for many years among the computer cognoscenti, Linux programmers can change and improve the software's source code as long as they agree to share their breakthroughs with other programmers. That attitude gave Linux a foothold among hard-core computer geeks (the Chronicle's Web site runs on a Linux computer), but not much traction in the mainstream. That has changed over the past two years. The biggest boost came from an unlikely source: IBM, the biggest technology company on earth.

This year, IBM will spend $1 billion on Linux -- all of Big Blue's servers are now Linux-capable. In addition, increasing numbers of Linux-based mainframes are being deployed by big corporate users, including recent adoptions by Korean Airlines and the Securities Industry Automation Corporation, which operates the computers and communications networks for the New York Stock Exchange and the American Stock Exchange. IBM is embracing Linux for a number of reasons, chief among them: Linux undermines two of its toughest competitors, Sun Microsystems and Microsoft, both of whom sell proprietary operating systems. If IBM sells a server for $1,000 loaded with Windows NT, Microsoft gets a licensing fee that comes out of IBM's profit margin. If that same server ships with Linux, IBM's profits are higher and Microsoft gets nothing. Big Blue has given Linux credibility it might not have gained otherwise.

Finally, Linux has three very important attributes that Microsoft's products don't have: It's free, it's stable, and it's not a security risk. By comparison, Microsoft's software, especially its Windows NT software, is expensive, crash-prone, and a security nightmare.

Pervasive Computing Will Be Here Soon

One of the coolest things I saw during my stint at Interactive Week was the Pervasive Computing Lab at IBM's sprawling campus in North Austin. Using mockups of a kitchen, a living room, and a garage, IBM is testing a myriad of gizmos (many of them powered by Linux) that are attached to the Web. Window blinds, stereo systems, TVs, lights, refrigerators, and a host of other devices could be controlled by a Web-based control system which could be activated by a Palm Pilot, cell phone, or standard computer. A lot of the stuff was silly -- but it convinced me that within a few years, all of our cars (and cell phones) will be Internet-capable. Instead of stopping at a motel in Gallup to see if it has any rooms available, your hand-held computer will get a wireless signal from the motel telling you how many rooms are available, what they cost, and what movies are on HBO.

Don't Short Dell

If you want to bet against Dell in the short term, be my guest. But over the long term, Dell will kick every other computer and server-maker's butt.

The rap on Dell is that the company isn't innovative. It steals ideas from other companies, incorporates them into its own products, then sells them. While that can be argued, Dell is the low-cost king of what has become a commodity business. Dell has perfected two things: manufacturing and supply-chain management. No other company can beat them on price. That means that Hewlett-Packard, Compaq, Gateway, IBM, and the other PC makers will have to fight each other for Dell's crumbs. Dell will win. Do not bet against them.

The Baby Bells Are Evil

Remember just a few years ago, when Southwestern Bell said that very soon, all of its 60 million customers would have access to high-speed DSL lines? Well, they lied. Last month, the company announced that it was slowing its roll-out of DSL, called Project Pronto, because of regulatory problems.

What a load of bullshit.

Federal regulations on DSL haven't changed significantly since 1998. Southwestern Bell simply hasn't managed its DSL roll-out very well. And DSL hasn't been as profitable as the company hoped. Rather than improve on their roll-out, SBC is cutting capital expenditures to make sure they keep profits up. Nothing wrong with that. Profits are good. But San Antonio-based SBC, which owns Southwestern Bell, made sure that it hobbled or eliminated all of its competitors in the DSL market before it slowed down Project Pronto. Despite federal regulations that required SBC to share its phone lines with companies like Rhythms NetConnections, Covad Communications Group, and Northpoint Communications, SBC dragged its feet every step of the way. When Covad or the others wanted to install a DSL line for a new customer, SBC's technicians were slow to respond or didn't respond at all. In addition, SBC and the other Baby Bells often charged Covad and the other competitors higher line-sharing rates than they were charging their own in-house DSL providers.

Now, with Covad in Chapter 11 and Northpoint and Rhythms out of business, consumers who want DSL service only have one choice, SBC. And SBC is making millions of them wait.

When it comes to exercising monopoly power, SBC makes Microsoft look compassionate.

There Are a Lot of Dumb Venture Capitalists

Just because a venture capital firm has lots of money, it doesn't mean the people that work there have a brain in their heads. Take Willis Stein. Please.

Sure, it sounds like sour grapes. Bear with me. In late 1999, Chicago-based Willis Stein bought Ziff Davis for $780 million. The price was way too high. By late this year, it was obvious that things were getting tough. At Interactive Week, we knew the company was struggling, but we also knew we were one of their best and most profitable publications. In 1999, the magazine made $30 million in profit. In 2000, it made $17 million. This year, it was expected to lose $3 million -- not small change, but certainly bearable unless the recession lasts much longer than currently expected.

Despite the consistent history of profits and despite the fact that the economy now appears to be looking up, the idiots in charge shut us down. At the time they closed us, Ziff Davis was launching two (TWO!) new magazines aimed at the same market segment: chief information officers and chief technical officers in American companies. The company was also launching a pair of ad-supported Web sites. I guess the geniuses at Willis Stein haven't heard of Salon.com.

Okay, I'm griping a little. But I can't complain. I worked with some really smart people. I learned a great deal, and I did it at their expense. I got to meet a lot of interesting people and do some nice traveling.

Plus, I'll always be able to tell my grandchildren, that once, during the legendary Internet Boom, I had stock options: all 5,520.67 of them. ![]()

Got something to say on the subject? Send a letter to the editor.